I try not to write anything on this blog, not even the slightest bit political, because we have different opinions on different topics and there’s no one here for that. Regardless of your electoral persuasion we can all enjoy our aging little silicone artefacts together. But this week I was going crazy, and the reason is actually on topic, because I found the price of the old items I was ordering almost doubled due to US customs tariffs and even more than the price of those items. It was eventually resolved, but not without my complaint and some time on the phone.

Although we make regular trips down there, your humble author is based in California and also the floodgap computer lab. For newly manufactured items and parts it has generally been my policy to purchase parts from United States vendors well in advance of tariffs, as this eliminates various irregularities and comes in more quickly. If they are going to drop-ship that’s their problem, not mine, because they advertised it was already here. Since such goods are generally newly produced, current tariffs would logically apply and I do not have to deal directly with this policy: any tariffs must already be paid in order to receive them state-side.

But for NOS and used parts, especially if you’re a collector like I am for some systems, you buy where you can find them. Incidentally I wanted to buy a second Apple Network Server logic board because my ANS 700 is acting a little weird (don’t say caps) and I still want a good spare for the ANS 500. These don’t exactly grow on trees, but, as it turns out, the vendor I bought my current spare logic board from (pre-tariff) had another one in stock. The logic board doesn’t come with the regular ANS AIX ROM SIMM nor cache, so we’d like each of those, and it also had an Apple BTO Twin Turbo video card (I believe originally for the Power Macintosh 9500) that might also be good for one of the other beige PCI Macs. These are all new old stock items in Apple Service packaging because apparently Apple hasn’t made or sold any of these parts in decades. According to the seller, they came from breakdowns of new machines that Apple was unable to sell and official surplus turned into new stock. The seller is based in an EU country, so we’re not talking some shady Shenzhen shop operating from a liftgate across the street. (I am not taking the name of the seller as it is not his fault and I am sure he would not like to be contacted about this.)

The items came to €296.00, approximately US$355 at the spot exchange rate, plus €48.10 for UPS shipping. It is much less than before de minimis Also discount when shipping starts. We had to do UPS because their particular country’s postal service limits the shipment value to US$100 to the United States due to tariffs, which required them to spend a substantial amount of time at the UPS drop-off depot and paperwork, which was more than they expected and I appreciate it very much. Any import requires you to come up with a Harmonized System code for what you’re shipping, which then maps to a Harmonized Tariff Schedule code specific to the United States. These parts are all populated PCBs and most of the populated boards, as per prior decisions, are classified with the HTS code of 8473.30, with which the seller has tagged all four items. This code is for “Parts and accessories of machines of heading 8471″ [Automatic data processing machines and units thereof].” If you look under the Harmonized Tariff Schedule search engine for this code, you find a fee rate for some subtitles that is most of 35 percent, or even if these are products of the People’s Republic of China (they are so old that I do not know their exact origin, but I have no evidence to believe that these were originally so), so maybe, maybe, Perhaps Additional 25 percent. The declared price was the purchase price in Euros and he also took insurance. The package left the depot without incident and made its way across the continent.

The first sign of trouble came over the weekend when I got an unexpected message.

The UPS shipping agent indicated that the parcel was subject to the Section 232 tariff on steel and aluminum, which required me to fill out a UPS-specific form certifying the steel and aluminum content of the package. (This is an important distinction because Section 232 is not part of the current case before the U.S. Supreme Court (PDF), only reciprocating tariffs under IEEPA.) These should contain little or no aluminum as the boards and traces will be copper. However, a PCI card will likely have a steel bracket, so I looked up the specific mass for them and chose the fairly high number of 149 grams, almost certainly an overestimate but with this stuff it’s always the safest bet, then looked at the spot price of stainless steel and calculated a steel material value of $0.48 based on that weight. I marked “not applicable” for everything else and sent it back. He accepted it.

In the background, it all goes into U.S. Customs and Border Protection Form 7501, also known as the Entry Summary. It is important to understand that in this situation, as the UPS broker you are No Actually importers of record – they are. You are the “final sender”. Based on the information provided and the broker’s agent’s decision, a tariff is assigned and added to the paperwork, which is “assessed” by CBP, but in practice it is evaluated by the broker based on what they expect CBP to charge under current regulation. Usually you do not see this form. CBP does spot-check them, but most people just get tested. Since UPS is the importer in this situation, they also pay a tariff calculated “in advance” to clear customs, and then they charge you that fee in addition to their broker fee.

It took several days for the actual tariff bill to arrive, which was on Monday morning. Now, the initial e-mail states this:

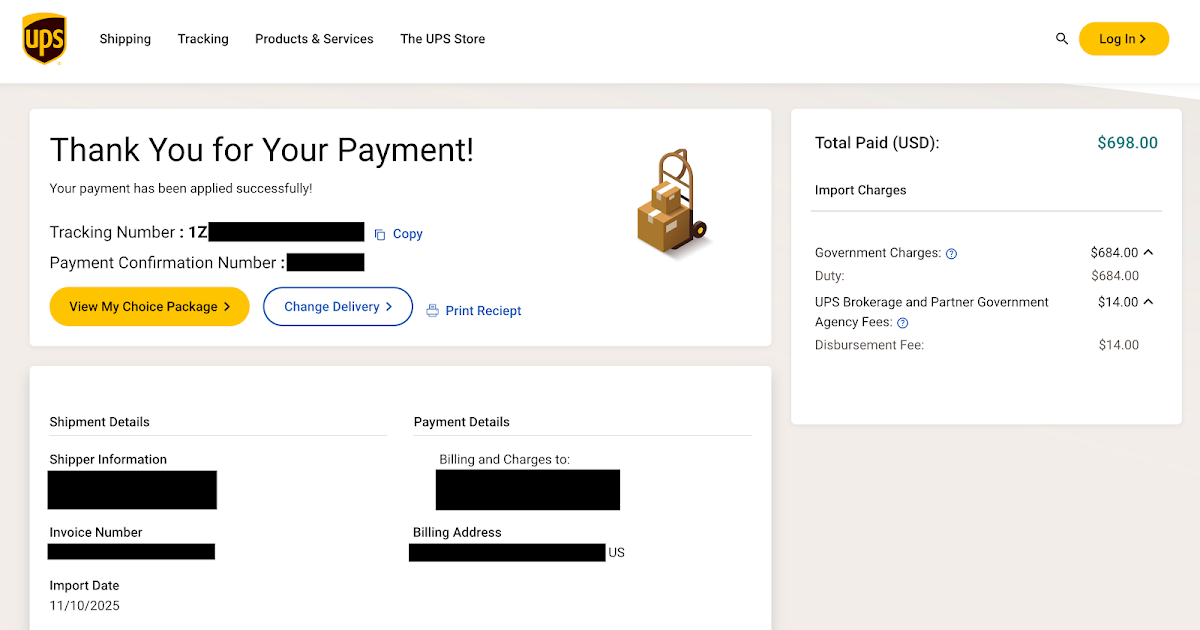

Yes, the initial bill was US$711. However, when I logged in, I got a total of $698 because it had not been delivered yet, which also included the $14 brokerage fee.

However, the timing was critical, because he was coming that dayIt was absolutely disrespectful of me to do this, but I paid the full fee on the spot, and that’s The right thing to do. The last thing you want is for your package to get redirected to a warehouse pending your payment, as any shipper will start paying storage fees and they will have no incentive to get it out of storage quickly. For UPS, a direct quote from their own agents, “Warehouse fees will be added at the rate of $20.00 per day and $0.04 per pound on shipments held in our warehouse over two business days. … On the 15th day, all shipments will be cleared by U.S. Customs for general order warehousing. Any shipments moved to a GO warehouse will be assigned additional warehouse fees in addition to any UPS warehouse fees. If charged, these Charges must be paid in full before the shipment can be removed.” Obviously I wanted no part of that.

After the system advised me that the package would be delivered on schedule, I continuously abused the AI chatbot on UPS’s home page until it asked for my phone number and I got a callback to their phone support line. The first person on the line advised me that they could not handle the tariffs and transferred me to another department, after which I (not an exaggeration) spent 45 minutes waiting until it was answered. This new agent said it was dealt with through a specific subgroup of the UPS Post Entry team that didn’t do anything by phone. (These brokerage teams typically operate out of the Kentucky UPS Worldport hub at Louisville Muhammad Ali International Airport, formerly Standiford Field, hence its IATA code of SDF which also appears in UPS documentation.) He gave me an e-mail address that looked like line noise but I confirmed it with him twice and also that I had to put the tracking number with the magic words “Disputed Duties and Customs Fees” in the subject line. Had to put. I stated in the message that the fees have been paid, but I believe they are unfair and incorrect, and also stated that I have submitted Section 232 paperwork when requested.

It took a day to get a reply, then the United States Veterans Day holiday arrived, and I finally heard from a different agent yesterday that they had “fixed this shipment.” What they did was they filed an amended form 7501 and this 7501 they actually sent it to me so I could see the results. The stated price was changed to US$342 (I think there was a difference in the spot exchange rate at the time of filing) and it now had two HTSUS numbers. The entire $342 was attributed to 8473.30.2000, which was a slightly different code for “Parts and accessories, including face plates and lock latches, of printed circuit assemblies”, which may refer to the bracket I declared on the Section 232 form. There was no tariff on it (“free”). However, a second code 9903.02.20 was added, which is just a long-winded way of saying tariffs (in this case 15%) on “EU product goods”. It was $51.30 and the final tariff.

By the way, everything arrived safely and in excellent condition (although I did open the antistatic bag on the ANS board to remove the Maxell battery, which Apple always ships with logic boards). However, I would like to point out for accuracy that there is no country of origin printed on the ANS logic board, ROM SIMM and cache DIMM. Only the Twin Turbo card does this, and it says…

.. But since it was not a major part of the order, it seemed like I was wasting more time than ten or fifteen rupees in appealing against it. Your mileage and motivation may vary.

Now when UPS was with me for the $632.70, the amended agent said, “Any difference between the amount paid and the amount now shown will be automatically refunded to you. Most of the time, this is done by check sent to the billing address, you can expect it between 2-6 weeks.” They didn’t say when they don’t use checks (I paid by credit card), but they gave me a phone number for accounting I would call if UPS fails to pay off this particular interest free loan.

So this is a disgusting story. Even though UPS (mostly) got it right, I’m still unhappy with them for messing up so badly in the first place because I don’t have the money until they agree to reimburse me. You’d think someone would notice that such a big duty for a transaction of this size seems a bit odd and maybe call it a supervisor or something. I am also unhappy with them that they only alerted me to the final cost of the tariff when the shipment was inbound and due for delivery, whereas it was assessed earlier, because unless you want to take your chances with their brokerage warehouse, they have you over a barrel at that point. The fact that it could be appealed so quickly – and overturned in a matter of days, something that rarely happens with the federal government – largely shows that it was his call to duty in the first place. This obviously gives them more money over those who won’t pay right away, but it’s undeniably very poor customer service. Unfortunately, my unscientific survey of reports at UPS Reddit indicates that I’m not the only one to find this kind of disproportionate assessment.

Regardless, if this happens to you – whether it’s FedEx or DHL or UPS or whatever – pay it off And Then Appeal it. Do not let your shipment leave the warehouse and return it to the sender; Since chances are the sender (since they are likely the importer of record) has already paid the fee, they will want their money back and you will get the money back. And Item. But, stupidly, appeal to it: just because you may agree with it politically, doesn’t mean they got it right.