Oracle is in a difficult position. It’s already burning cash, with plans to burn tens of billions more over the next several years as it tries to transform itself from a leading software company into an AI cloud-computing giant — leasing the vast clusters of advanced computer chips needed to power applications like OpenAI’s ChatGPIT.

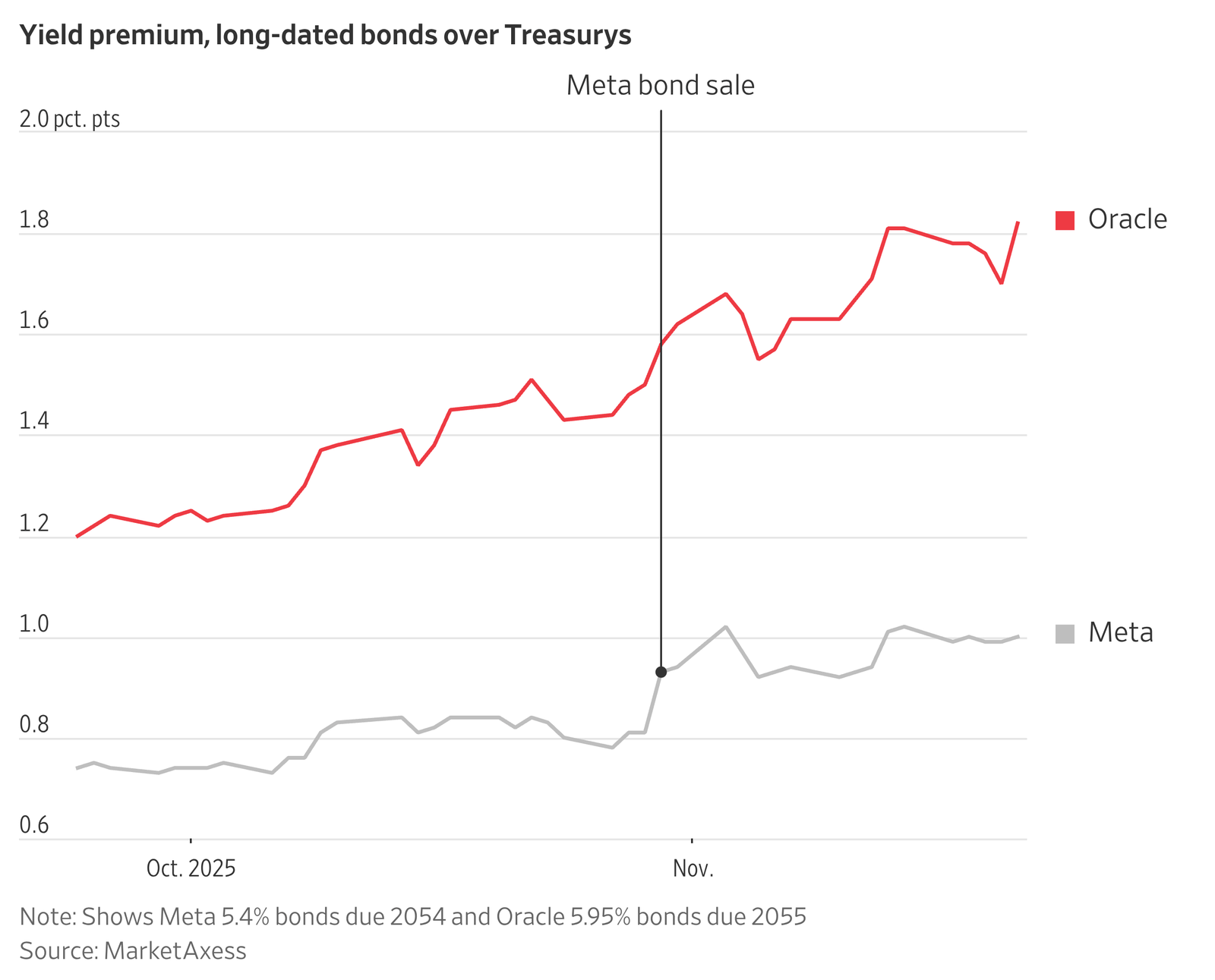

Rated two notches above speculative-grade territory, Oracle’s bonds now yield higher yields than almost any of their investment-grade tech counterparts. Jordan Chalfin, a senior analyst at research firm CreditSights, said Oracle could issue about $65 billion more bonds over the next three years.

The modest increase in the cost of debt should not make a big difference to the company, given that its interest expenditure will still be lower than its capital expenditure. But Chalfin said, Oracle needs to maintain an investment-grade rating, because the amount of funding available to lower-rated companies is not enough to meet its needs.

In recent weeks, there has been a surge in trading of Oracle credit-default swaps – an instrument sometimes linked to the 2008-09 financial crisis. Although bond investors generally saw nothing surprising in the activity, the focus on the theme helped weigh on Oracle shares, which have fallen 24% this month.

<a href=