One of America’s most affordable pathways to homeownership is disappearing.

In manufactured home parks – sometimes called trailer parks or mobile home parks – rents are rising rapidly due to large-scale purchases by private equity firms.

Although the entry of private equity into the housing market is nothing new, the purchase of mobile home parks by investment firms is on the rise – with disastrous consequences for residents. According to census data, rents at these parks have increased 45% over the past decade. Once a park is sold, the risk of eviction the following year increases significantly.

I am a poverty law attorney in Virginia, and many of my clients are residents of mobile home parks. Over the past four years, I have watched as their communities were sold one by one to large investment firms. Many of them are desperately struggling to protect their homes – for some, their only source of wealth – in the face of rising rents and threats of eviction.

immovable mobile home

Today, the term “mobile home” is a misnomer.

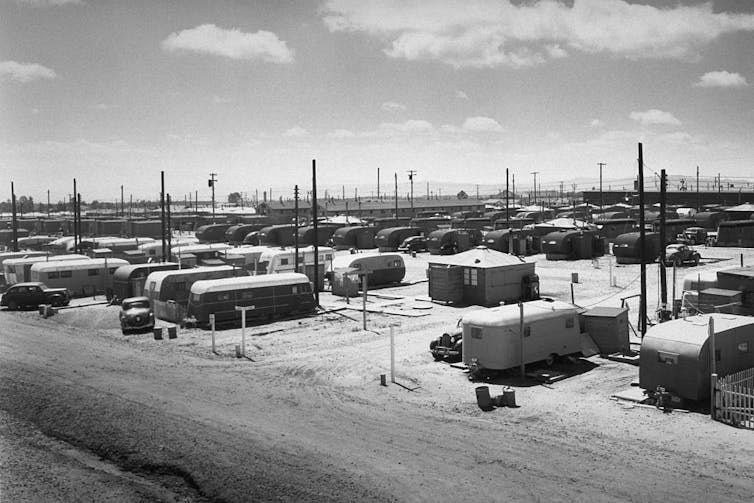

Historically, mobile homes were trailers designed for travelers and workers living near factories. As many veterans returned home after World War II, trailers provided them with an easy and affordable way to obtain housing despite the shortage. Trailers could be moved from one place to another as people either went to school or looked for work.

Corbis/Getty Images

A change came in the 1950s. Those with higher incomes purchased homes, and those with less means continued to live in mobile homes. Eventually, mobile home communities emerged across the country as places for people to park their mobile homes for months, years, or even permanently.

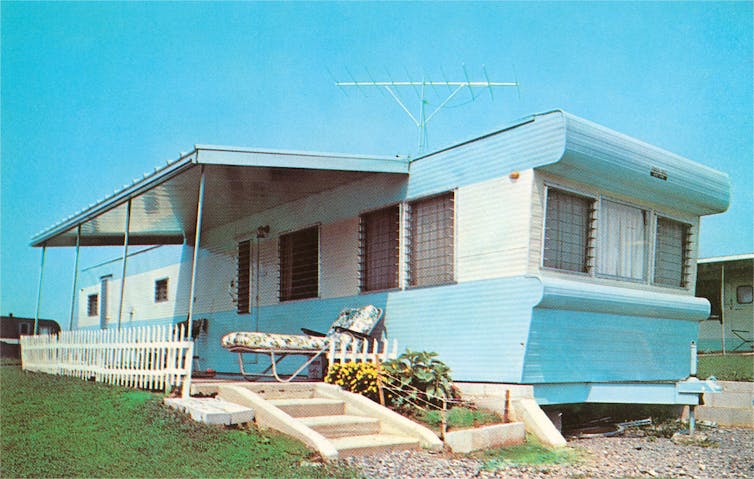

Nowadays, mobile homes are often called “manufactured homes”. These are assembled in factories and rarely moved once purchased and assembled. In fact, over 90% of manufactured homes never move from their original site.

Today, approximately 20.6 million Americans live in a mobile or manufactured home. About one-third of mobile homes are located in mobile home communities.

In these communities, residents usually own the home, but they rent the lot on which the home stands. They are responsible for the maintenance of their home, but the park owners are responsible for the park’s infrastructure, including road maintenance and sewage systems.

Although many Americans still consider these homes mobile, they are extremely expensive to move. Many have had their wheels or hitches removed years ago. Additionally, many owners of trailers or manufactured homes have invested in additions such as porches or extra rooms, making these homes even more difficult to relocate.

Found Image Holdings/Getty Images

Private equity swoops in

According to the National Low Income Housing Coalition, no state has enough affordable housing for the lowest income people.

Amid the housing affordability crisis, mobile homes are seen as a way for people with limited income to generate wealth and reach homeownership. Indeed, more than half of all manufactured home owners earn less than US$50,000 per year, and one-third are over the age of 60.

However, it is becoming more difficult for many people to maintain this type of home ownership due to the increasing purchases of mobile home parks by large investment firms – a trend that mirrors the rest of the housing market.

Increasingly, housing is being treated as a commodity rather than an essential social good – what is sometimes referred to as the “financialization of the housing market”.

For private equity firms, housing has been a fruitful investment. But to get maximum returns on their investment, they generally increase fares and cut costs. Company leadership is often completely divorced from its tenants; Instead, they employ on-site and regional managers who exercise inconsistent control over evictions and rule enforcement. Overall, this financialization has changed the way people with limited incomes obtain shelter – including owners of mobile homes.

In the past, manufactured home communities were largely “mom-and-pop” enterprises. Although they were still subject to abusive practices, tenants usually knew their landlords and visited them often, and rents were much more stable.

RJ Sangosti/MediaNews Group/The Denver Post via Getty Images

In 2020 and 2021, institutional investors accounted for 23% of all manufactured home park purchases, up from 13% between 2017-2019. Now, 23 private equity firms own more than 1,800 parks in the U.S.

Once purchased, the rent for the lot usually begins to increase. Residents of mobile home parks are particularly vulnerable because of their circumstances: since it is very difficult to move their homes, they are essentially stuck when faced with rising rents. A study of Florida mobile home communities found that in the months following park sales, eviction filings increased by 40%. Residents are often forced to choose between paying exorbitant costs to relocate their home or paying unaffordable lot rents.

State laws put pressure on tenants

Because they are so unique, manufactured home communities are often governed by a special set of state laws.

In my state of Virginia, the Manufactured Home Lot Rental Act contains rules that park owners and residents must follow. If someone is evicted because he cannot pay the rent for his land, he still has his house, but he can no longer live in the park.

Often, states set short deadlines for someone to move their home after an eviction. For example, in North Carolina, a tenant has only 21 days to remove the manufactured home from the park following an eviction judgment. In Virginia, a homeowner has 90 days to move or sell their mobile home after being evicted, but they must continue paying rent during that time.

Gina Frazee/Los Angeles Times via Getty Images

In many states, if a resident fails to move their home in time, the park owner can repossess the home or move it. Even if the resident lives in a state that continues to protect mobile home ownership against park owners, this is often difficult to enforce, as park owners may now have a lien on the mobile home for any amounts owed by the resident. The result is that many evicted residents lose their homes.

putting power back into the hands of residents

Currently, only 22 states have laws that require advance notice to residents of park sales. Most simply provide a timeline for owners to notify park residents of their intention to sell.

Nonetheless, many states are coming up with strategies to save residents from being forced out and help them gain ownership of parks.

Recently, Maine passed a law that gives park residents the right of first refusal if their park is for sale. The law also imposes fees for out-of-state investors purchasing parks, which may put residents in a better position to purchase parks where they live.

In other cases, residents have banded together to purchase the park by forming a cooperative with outside support. They then apply for financing and purchase the park. Resident Owned Communities USA is an example of an organization that works to support resident ownership in manufactured home parks.

Many advocates are also pushing for rent control policies in mobile home parks, limiting the amount new owners can raise the rent annually. In 2019, New York State passed a law limiting annual rent increases in mobile home parks to 3%, although this can increase up to 6% annually in certain circumstances.

Additional solutions include limiting evictions to narrow circumstances, tightening lot lease contracts to give residents additional protections, and strengthening zoning rights for existing mobile home parks.

In my practice, I see park residents eager to maintain their long-standing homes and communities in the face of outside investors and unresponsive local governments. But unless these solutions are widely adopted, residents will continue to lose their wealth – and with it, this important path to homeownership.