Lawrence Cawley,

Phil Shepka And

Charlotte Rose,BBC London and East Investigations

Laurence Cawley/BBC

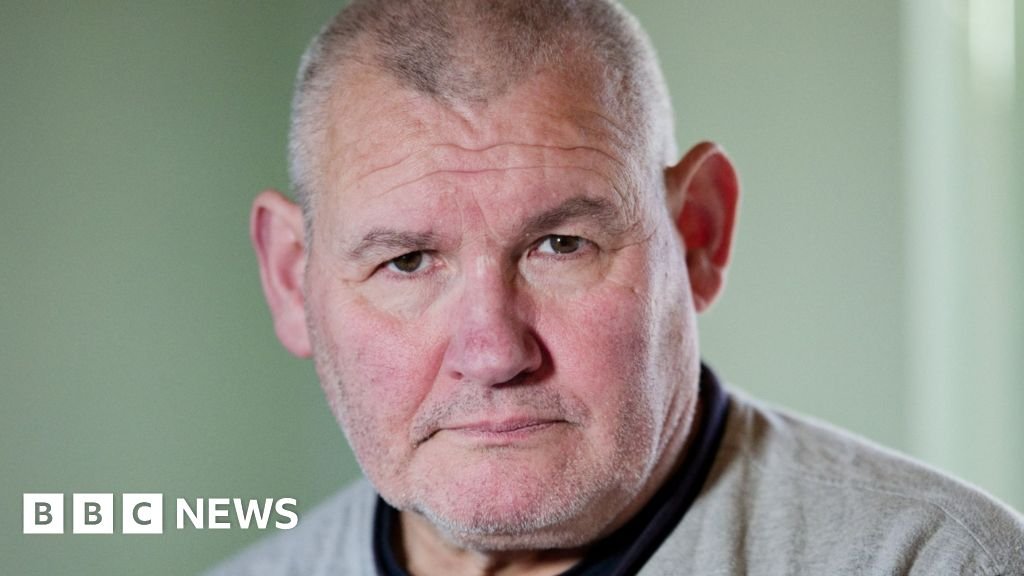

Laurence Cawley/BBC“I’m waiting for the bailiff to knock on the door, take my keys and let me out,” says Jose da Costa Diogo, one of thousands who have been told their homes will be repossessed this year.

The 65-year-old man learned he would lose his home in Thetford, Norfolk, during a 10-minute county court hearing earlier this year.

The interest-only mortgage on the three-bedroom property was taken out more than 20 years ago in the hope that he and his then wife would eventually save enough to cover the capital sum.

But the breakdown of the marriage and his ex-wife moving to Brazil in 2015 left Mr da Costa Diogo unable to repay the £80,000 he owed.

And because his ex-wife still had both the mortgage documents and the property deed, he was also unable to sell the property to cover the outstanding balance.

“I tried to do the right thing and pay all the bills,” he said. “After 25 years, I have nothing to show… but I still have to live.

“I’m going to be homeless.”

Laurence Cawley/BBC

Laurence Cawley/BBCCourt figures show the number of mortgage repossession orders in England and Wales reached 10,853 in 2024-25 – the highest number in five years.

Experts say this increase is due to several factors, including interest rate increases and the general cost of living increase.

Mr da Costa Diogo registered as homeless with his local authority, Breckland Council.

He is far from alone.

The BBC asked every English council with housing responsibilities how many people have become homeless as a result of mortgage repossession.

According to the 240 councils that provided comparable data, the number has doubled – from 1,517 in 2022-23, to 2,370 in 2023-24.

In the recent year it was 3,406.

Local government figures say rehoming people affected by occupation is putting further pressure on council resources.

Tom Hunt, who chairs the Local Government Association’s Inclusive Growth Board, said: “As more and more people turn to their council for help, local authorities are having to stretch budgets further.

“The temporary housing crisis facing councils is only getting worse.”

Laurence Cawley/BBC

Laurence Cawley/BBCLucy Davis observes that possession can happen on a daily basis.

A housing law consultant with Suffolk Law Centre, she offers her expertise to people in need in the courts of Suffolk and Essex.

“I’m seeing a huge number of people being affected by this,” Ms Davis said.

“People get into massive difficulties through no fault of their own.

“There are often mental health issues, employment issues, family issues, and I think it can get out of control very quickly.”

On the day the BBC joined Ms Davies for a day at Ipswich County Court, where she volunteers with the Ipswich County Court Advice and Representation Service, none of the five people facing mortgage repossession cases attended.

It was often characterized by shame, despair, and the feeling that losing one’s home was a foregone conclusion, he said.

“Coming to court is scary enough, but it doesn’t have to be.”

She urged people to seek advice as soon as possible and said the cases she was seeing were becoming “more severe or more serious”.

He said that it is becoming difficult for people to get housing legal aid.

Paul Gorton of The Law Society’s Housing Law Committee agreed.

He said that the historical lack of investment in legal aid meant that fewer and fewer law firms were able to offer legal aid housing advice.

“Many people are too wealthy to be eligible for legal aid but cannot afford to pay for legal advice,” Mr Gorton said.

“We have both a desert of legal aid providers and restrictive eligibility criteria, leaving many people in limbo.”

A Ministry of Justice spokesperson said it had recently announced “the first major funding increase for housing legal aid in three decades – an increase of 24%”.

“This investment will help ensure effective access to justice for some of the most vulnerable people in our society, while supporting a more stable and sustainable legal aid sector,” the spokesperson said.

Laurence Cawley/BBC

Laurence Cawley/BBCHome repossessing is “always a last resort” for lenders, said Karina Hutchins, head of the mortgage policy team at UK Finance, the trade association for the banking and financial services sector.

He said the number of mortgage repayments has been rising in recent years, but the current level remains “historically low”.

“Recapture is really, really unusual.”

He said in the wake of the 2008 financial meltdown, around 2,000 homes were occupied in the first quarter of 2025, compared to 13,000 homes in the same quarter of 2009.

“I can imagine that if customers are experiencing financial difficulty they are really worried and distressed, but they don’t have to go through this alone,” Ms Hutchins said.

“The sooner they contact their mortgage lender, the more support and help that lender can give them and the more likely they will be to get back up to date with their mortgage.”

Options offered by lenders include lower mortgage payments to get back on track, advice about budgeting and other tools and loans to charities and aid organizations to understand “their full financial situation,” she said.

Charlotte Rose/BBC

Charlotte Rose/BBCHenry Sabati McRae, who lives in Croydon, south London, has so far managed to evade capture.

A software developer by training, Mr McRae’s financial troubles follow the deaths of a brother in 2020 and his mother in October 2023.

Since October 2024, the 51-year-old has been out of work and despite applying for hundreds of jobs, he has not managed to get a new contract.

“It doesn’t matter how much savings you have,” he said.

“It gets wiped out within a few months. I managed to spread it out as much as I could because I was very conservative about what I was doing.”

- If you have been affected by this story or want support you can find organizations that provide support and information bbc action line,

Nevertheless, the mortgage outstanding on their two-bedroom flat eventually rose to almost £13,000 and their bank said it would try to repossess their home if the figure was not reduced by £8,000.

“The most important thing for me at that time, and I think for anyone, was to keep a roof over my head,” he said. “Otherwise it will get out of control.”

To cope, he has turned to selling his possessions on an Internet auction site and accepting a loan from a friend.

The BBC has spoken to several people facing foreclosure proceedings, Mr McRae said the experience was extremely “humiliating” and his instinct was initially to “close the curtains”.

However, he said that realizing he was not alone and speaking out about it had helped him plan “a solution to it”, just like an IT problem.

Charlotte Rose/BBC

Charlotte Rose/BBCBusinessman Mike Williams, who lives 10 miles (16 km) south of Mr McRae in Caterham, Surrey, has also avoided repossession.

He mortgaged his self-built house after he and his wife separated.

In three years, payments on an interest-only loan, which was taken 20 years ago, have tripled.

He says this has left him with “virtually no disposable income”.

In court, he renegotiated a repayment plan that would add an additional 20% to his monthly payments.

In five years, when the mortgage term is up, he intends to sell the two-bedroom house he and his wife built from the ground up.

“It has a lot of emotional significance for me, so yes, it’s heartbreaking,” he said.

As far as Mr da Costa Diogo is concerned, his bank has repossessed the property.

The same month it was repossessed, the BBC saw a three-bedroom property in the same Thetford street as Mr da Costa Diogo’s on the market for £160,000 – almost double the amount he owed.

Within hours of losing their home, they were given emergency accommodation in a small ground-floor studio in North Suffolk.

“I walked out of my house with a suitcase and a bag of essentials and told the council ‘I’m homeless.’

“It’s a roof over my head. I’m trying to keep things simple because what’s the point of complicating things?

“I survive and I move forward.”

With additional reporting by Zoe Dennis, Stephen Menon, Jonathan Fagg and Stuart Bailey.

Receive our flagship newsletter with all the headlines you need to start your day. Sign up here.