chris bramwellAnd

emer morrow

liam davidson

liam davidsonThere is a lot of speculation about what will be in the budget and what will not.

Ahead of her speech on Wednesday, Chancellor Rachel Reeves has confirmed that both tax rises and spending cuts are on the table.

BBC News is talking to people of different incomes about what they want to see in the Budget.

If there are issues you would like to see covered, you can get in touch via BBC Your Voice.

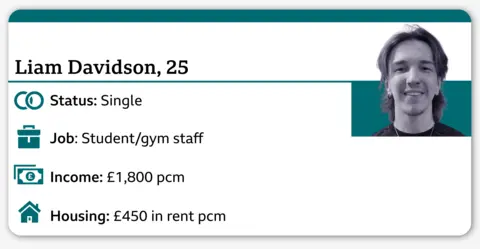

Liam Davidson is a third year student at the University of Aberdeen.

His student loans give him a monthly income of £800 and he earns £1,000 a month working at the gym.

After his essential bills, he says he has disposable income of £200-£250 and has noticed that food prices have continued to rise.

“Last month I was probably down to about £50 for the month with a week left,” he says.

Under-22s in Scotland get free bus travel and Liam wants the scheme to be extended to students of all ages and the rest of the UK.

“I’m spending £40 a week commuting to university – it’s cheaper to drive,” he says.

Last month, the government said a trial of free bus travel for under-22s in England would be “unbearable”.

‘We earn £60,000 and want stamp duty abolished’

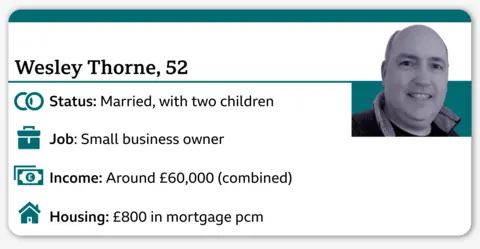

Wesley Thorne, 52, and his wife Toni live near Bristol with their two daughters.

They want a bigger house, but say stamp duty would add £15,000 to £20,000 to the cost of moving a house, so they want the tax abolished in the Budget.

Stamp duty is a tax charged if you buy a property or land for more than a certain price in England and Northern Ireland.

“To me, it just seems like an immoral tax on owning a home,” Wesley says.

He hopes the Chancellor will “either scrap stamp duty altogether (or) make it only apply to very high-valued properties,” he says.

Wesley and Tony run an online sweets shop and market stall, and are members of the Federation of Small Businesses. He currently pays himself around £60,000 a year, but this amount can vary.

He says cost pressures have “never been worse”, with skyrocketing prices of sugar and chocolate, national minimum wage rises and business rates hikes “hitting us from every direction”.

Currently small businesses like Wesley and Tony’s must register to pay VAT if their taxable turnover is more than £90,000. Wesley would like this limit to be higher.

‘I earn £25,000 and want to spend more on social housing’

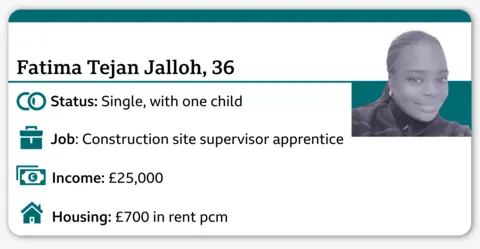

Fatima Tehan Jalloh is a single mother who lives in council housing in North London.

She says she loves her job as a Level 4 Trainee Construction Site Supervisor.

She works full-time and her daughter goes to nursery, which costs £600 a month.

It’s one of her biggest costs besides rent and bills, and she says the cost of everything is constantly “going up.”

Despite this, she feels she is doing fine and thinks the Chancellor should raise taxes and spend more on essential services.

“If I knew it was going to go into schools and increase social housing, I would certainly be happy to pay more,” she says.

‘We earn £150,000 and have EVs. ‘We should pay to use the roads’

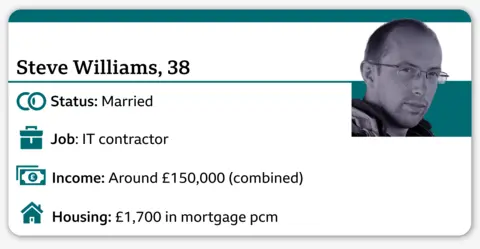

Steve Williams is an IT contractor and his wife is a consultant. They are both self-employed and estimate that they earn a combined £150,000 a year.

They live in Basingstoke and both drive electric vehicles (EVs).

Steve says he wouldn’t have a problem with the rumored EV tax.

“I use the roads, so at the end of the day I should pay for their maintenance,” he says.

“You could also tax petrol cars on their per mile usage, although the discussion at the moment is that this is just for electric cars, which is unfair,” says Steve.

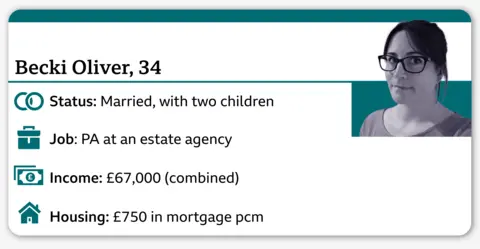

‘We earn £67,000 and want to spend more on the NHS’

Becky Oliver, 34, lives in Bourne, Lincolnshire with her husband Tim and their two young children.

She works as a PA in an estate agency and says she wants the Chancellor to tackle the rising cost of living.

“We can’t go out for food, we can’t treat the kids; our last holiday was our honeymoon in 2019 – we never go away as a family,” she says.

“I know these things are luxuries, but considering how hard we work, it would be nice to be able to afford those luxuries.”

Becky says she is worried about the state of the NHS after taking her son to hospital.

She says she wants the Chancellor to increase funding for the health care system.

“I just feel the money is not being put in the right place,” she says.

“There are a lot of people in this country, and we need to be taken care of.”

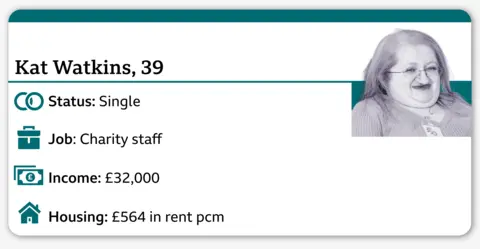

‘I have £32,000 and I’m worried about cutting mobility’

Kat Watkins lives in Swansea and works for Disability Wales. Her earnings amount to just under two-thirds of her income and she receives Universal Credit and Personal Independence Payment (PIP).

Kat has Osteogenesis Imperfecta Type 3, known as brittle bone disease, and says she faces high energy bills because she needs to charge her wheelchair and other devices.

She spends around £70 a month on insurance and food for her assistance dog, Purdy, and a recent wheelchair service cost around £1,000.

Some months are tough, she says. “Without my Pip, I would definitely struggle a lot more.”

There is speculation that the Budget may include changes to the Motability scheme which helps people with disabilities to hire a car.

Catt says she would urge Reeves not to “mess with mobility” because cutting the scheme “wouldn’t help people get to work at all”.

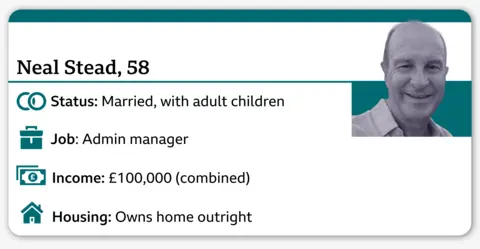

‘We earn £100,000 but worry about retiring’

Neil Stead and his wife Tara both work in administration – Neil in a contact centre, and Tara in a hospital.

With a combined income of around £100,000 and the mortgage on their Bradford home paid off, Neil says he is under no major financial pressure. But at the age of 58, he is worried about retiring.

“My concern now, as I approach later life, is when can I actually retire? Because the goalposts seem to be moving,” he says.

He does not want the Chancellor to “touch pensions” by replacing tax-free lump sum allowances with pension savings.

<a href