For years, flying to Hawaii meant boarding a big airplane. Two aisles and a cabin that seems built for trans-Pacific distances. Hawaiian Airlines didn’t just operate widebodies; It was defined by him. Brands, route maps and even the psychology of trips revolved around the same idea. For many years, Hawaii was not treated like a second long home territory. It was treated as if it was somewhere far away.

Other US carriers fly extensively to Hawaii, but almost exclusively on long East Coast and hub routes. Alaska, American, Delta and United rely on narrowbodies for West Coast-Hawaii flights. The last carrier to build its entire long-haul identity around widebody service to and from the islands was Hawaiian Airlines, which had 24 Airbus A330s in its fleet and plans to follow suit with the first Boeing 787 Dreamliner.

This all changed when financial losses forced Hawaiian to sell Alaska Airlines, a carrier that served Hawaii with only 737s. Under Alaska, Hawaiian losses have been nearly halved, but reducing losses is not the same as making profits. The fleet plan now being filed with regulators appears to reflect that pressure.

We pulled out the Hawaiian (Alaska) 10-K filing from February 12 and went straight to the Hawaiian fleet schedule, showing how many aircraft the company plans to operate, acquire and retire in the coming years. When you look two years beyond 2028, the broader picture begins to change.

The A330 fleet is getting smaller, even as it gets better.

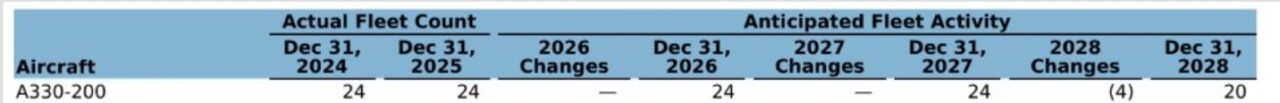

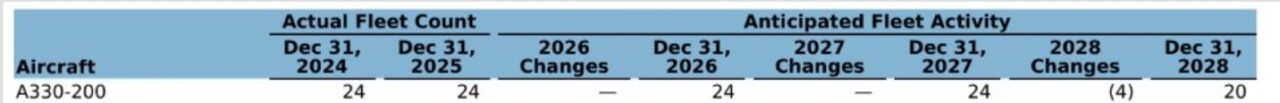

Today the fleet consists of 24 Airbus A330-200 aircraft. Those aircraft remain the backbone of the airline’s long-haul air travel. They handle several mainland routes that still feel like the traditional Hawaiian experience, and they support international services connecting to Honolulu around the Asia Pacific region. By the end of 2027, the aircraft number will remain stable at twenty-four.

In 2028, four A330 widebodies are scheduled to leave the fleet, reducing the total number to twenty. This is not an isolated step. That same year, four Boeing 787-10 Dreamliners arrived in Alaska, and the Max 10 fleet, which began arriving in 2027, continues to grow. The timing is deliberate and reflects the re-shaping of the fleet around different aircraft.

The incoming 787-10s are tied to Alaska’s global expansion out of Seattle, not to replace lost A330 capacity in Honolulu. As we reported last July, the Honolulu Dreamliner base is said to support about five aircraft internally. That means Hawaii’s A330 reduction doesn’t automatically come with a similar widebody increase at home.

Alaska’s $600 million Kahuawai Hawaii Investment Plan focuses on airport infrastructure and guest amenities. Separately, the company has announced a full A330 cabin redesign in the same year, 2028. This is a worthwhile investment in aircraft, even if it will be on a small fleet. Whether Alaska plans to reduce the A330 fleet beyond our current knowledge has not been disclosed.

The airline’s MAX 10 fleet will grow aggressively in 2027 and 2028. When those aircraft enter the system in larger numbers, the economics of mainland-air flight change. The higher capacity narrowbody with more premium seats makes it easier to justify flying the MAX 10 on some air routes that may historically support the A330.

If Hawaii loses the A330 aircraft and does not get the same number of Hawaii-based Dreamliners, fewer large aircraft will depart from and arrive at the islands. Fewer larger planes also means less cargo space associated with Hawaii. Cargo is a layer that does not appear on passenger seat maps. The A330 carries significant bulk cargo, which matters to geographically remote Hawaii for fresh food, mail, medical supplies and international freight connections. Narrowbodies can’t mimic that space, so as the widebody count shrinks, cargo lift becomes tighter until the frequency increases.

Widebodies aren’t going away. But with fewer of them, there is less flexibility. Every new route or schedule change has to come from somewhere.

Development of the Dreamliner is focused elsewhere.

The Dreamliner side of the filing reinforces what we reported last July. An internal memo shared with Beat of Hawaii and later confirmed by multiple aviation sources described Honolulu’s 787 base as capable of supporting five aircraft.

The current filing gives more context to this. Alaska operates five 787-9 aircraft today and will add one in 2026 and another in 2027. The larger 787-10 version will begin arriving in 2028, with four deliveries scheduled that year. By the end of 2028, the fleet will consist of seven 787-9s and four 787-10s, with additional 787-10 aircraft on order.

If Honolulu remains limited to five Dreamliners as the fleet grows, the majority of those aircraft are apparently located elsewhere, as the new Dreamliner branding tells the same story. Each 787 now wears Alaska’s global livery, and the long-haul expansion message continues to focus on Seattle.

There is one more obstacle. With only five Dreamliners in service today and one more arriving next year, Alaska is already rotating those aircraft to Seattle-NRT, ICN, LHR and FCO. Even the Seattle-Tokyo (NRT) route returns to the A330 on April 22 because there are not enough 787 aircraft to cover everything. This reality makes clear that dedicated Dreamliner growth from Honolulu, beyond the limited base mentioned earlier, is not in the near-term picture.

MAX 10 changes the main land-air equation.

The biggest growth in the fleet in the full disclosure document is not on the widebody side. Alaska will take delivery of fifty 737 Max 10 aircraft in 2027 and 2028, which is a huge number in just two years. On its earnings call, Alaska said the MAX 10 will include 5.5 percent more seats and 25 percent more first class seats than the MAX 9.

The higher capacity narrowbody with more premium seats makes it easier to fly the MAX 10 on some air routes that could historically support the A330. This doesn’t mean that widebodies disappear from Seattle-Honolulu or Los Angeles-Honolulu overnight, but it does mean that the economics are no longer in favor of deploying a 278-seat widebody aircraft.

Hawaii remains important, although it is no longer a development center.

Nothing in the filing indicates Alaska is abandoning Hawaii or downsizing. The twenty refreshed A330s will still represent a very large widebody presence. Based on the 10-K, Hawaiian’s A321neo fleet remains intact until at least 2028, and Hawaiian’s 717 interisland fleet sees no immediate replacement, even as those aircraft move deeper into the final period of their lifespan. However, both of those fleets remain sensitive to changes.

Hawaiian Airlines was created as a widebody airline that served Seattle. Alaska is building a global airline based in Seattle that provides air service. This difference becomes apparent when you look at where the new planes are going and where the old ones are going.

The widebody era in Hawaii is not ending, but it is becoming more defined and less expansive than ever. The 10-K simply builds the fleet, year-by-year, through 2028.

Have you noticed any differences in the aircraft during your recent air flights?

Main sources: Alaska Air Group Form 10-K filed with the U.S. Securities and Exchange Commission on February 12, 2026 (accession number 0000766421-26-000010).

Get the latest air travel news

<a href=