Believing that the pop-up was legitimate, Williams called the number listed for technical support and spoke to a person who raised alarm regarding the security of his financial accounts. “He told me, ‘Your financial sites are going to be at risk,'” Williams said, describing how the threat to their finances affected people and increased their anxiety.

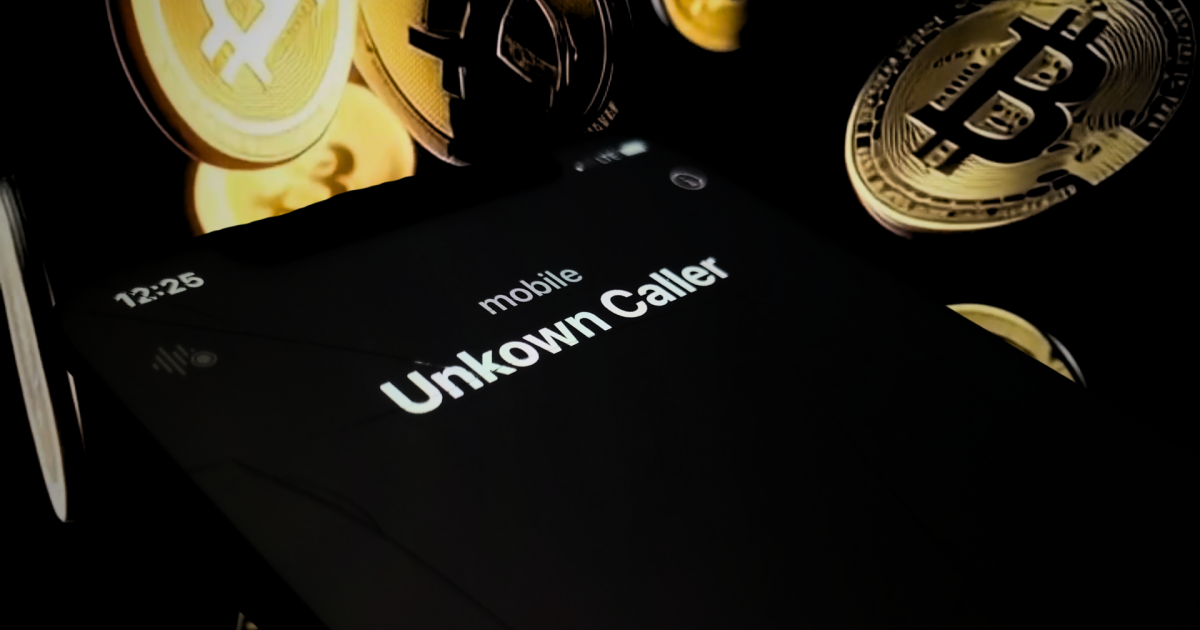

After the conversation, the scammer convinced Williams to withdraw money from her bank account and deposit it at a standard ATM. However, they later discovered that it was a Bitcoin ATM, and the account into which they had deposited the cash was controlled by the scammer. Over the course of two trips to the machine, Williams accumulated a large sum of money. During a second visit, a store employee warned him about possible fraud, saying, “I told him, ‘Don’t do that,’ and he walked away,” Williams recalled, adding that despite the warning, he continued the transaction.

The next day, Williams realized something was wrong and attempted to confront the scammer over the phone, but the call ended abruptly. Subsequently, he reported the incident to local authorities in Aransas Pass. In an effort to get justice, he reached out to AARP, which is helping him connect with a fraud expert to reevaluate his case.

Williams’ experience mirrors that of an 80-year-old Florida veteran whose plight was highlighted by NBC 6 South Florida. In that situation, the police intervened when one was about to deposit a large amount of money in a Bitcoin ATM while negotiating with scammers impersonating senior bank officials. In both instances, a false sense of urgency was a common tactic used by fraudsters to trick their victims.

AARP figures show that Americans could lose a total of $12.5 billion in 2024 due to fraud and scams – the highest figure on record. Older adults, especially those over the age of 70, bore the brunt of these financial losses, with an average loss of $1,000 reported. Scams related to investment and cryptocurrency emerged as the most expensive scams.

In light of her harrowing experience, Williams aims to raise awareness, especially among seniors and veterans, and urges them to be suspicious of unexpected messages or phone calls. “You can’t be too careful,” he advised. “Don’t believe everything you read on that computer or call the numbers. Be very cautious.”

For those who may encounter similar scams, AARP recommends reporting to the Federal Trade Commission at fraud.ftc.gov, the FBI Internet Crime Complaint Center at IC3.gov, or contacting the AARP Fraud Watch Network Helpline at 877-908-3360 for guidance on how to proceed.

<a href=