Tim Cook and his team took the news seriously. Wei had been reporting increases on earnings calls for the past few quarters, and the Taiwanese chip maker’s rising gross margins were evidence of its growing pricing power.

My sources tell me it wasn’t bad news.

Apple, which once dominated TSMC’s customer list, now needs to fight for production capacity. With the continued AI boom, and each GPU from customers like Nvidia and AMD taking up a larger footprint per wafer, the iPhone maker’s chip designs are no longer guaranteed a place among TSMC’s nearly two dozen fabs.

Wei probably didn’t tell Cook that Apple might no longer be his biggest customer.

according to kalpiyam After analysis and discussion with sources in the supply chain, Nvidia likely held the top spot for at least one or two quarters of the past year. “We don’t discuss that,” said Chief Financial Officer Wendell Huang. kalpiyam On Thursday, when he was asked about the change in client ranking.

The final data will be unveiled in a few months when TSMC releases its annual report – which includes revenues from its top customers – but it’s quite likely that Apple’s lead for the full year has shrunk significantly and could even fall below Nvidia. If it doesn’t happen in 2025, it’s almost certain to happen in 2026, my sources tell me.

Public data helps tell the story.

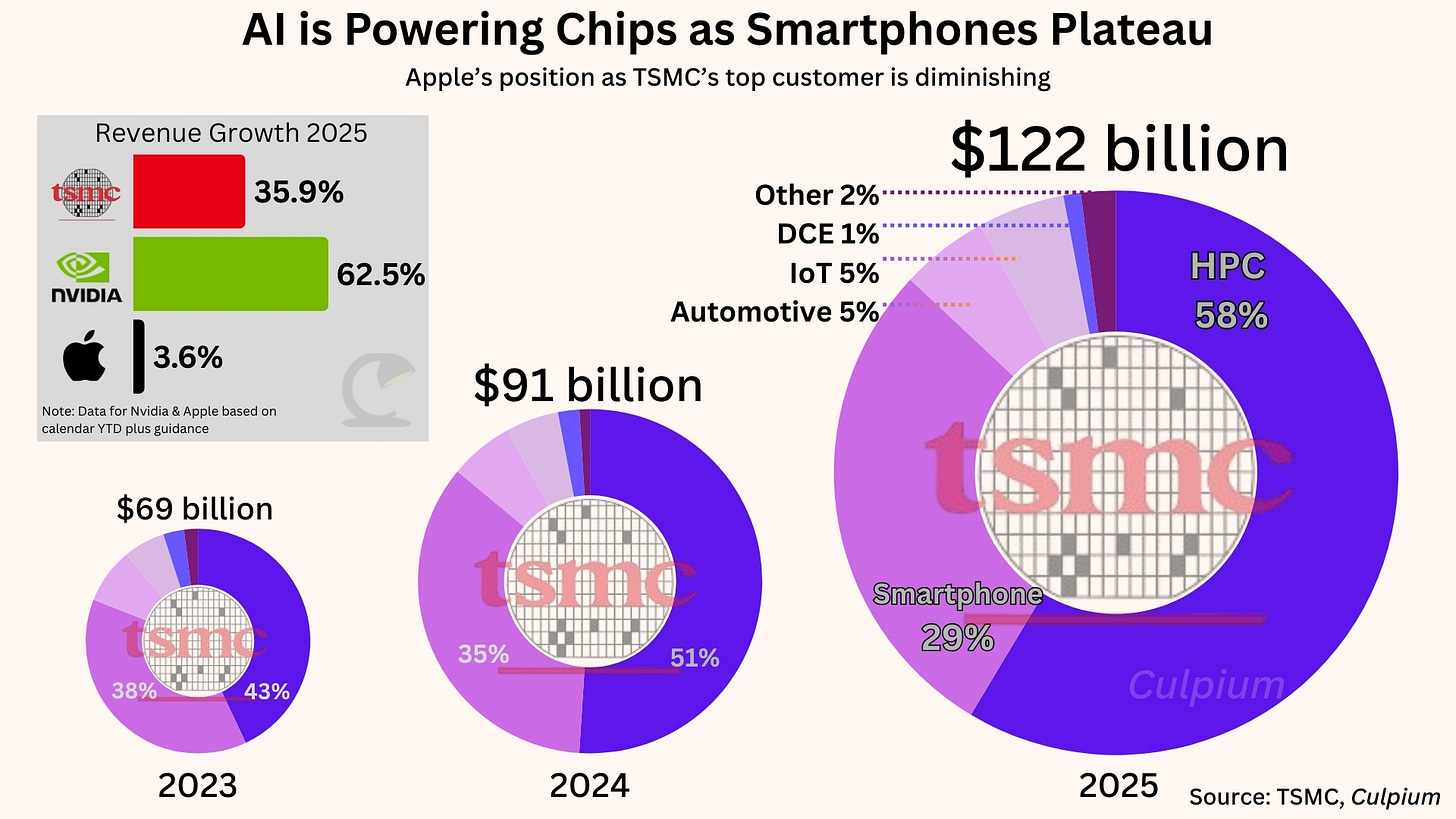

TSMC’s revenue rose 36% last year to $122 billion, according to the report Thursday. Nvidia’s sales are set to grow 62% for the fiscal year to January 2026, while Apple’s product revenue – which excludes services – is on track to grow just 3.6% for the 12 months to December 2025. kalpiyam Estimates based on earnings reports and company guidance.

Apple’s role as the primary driver of TSMC revenue growth ended five years ago. TSMC’s sales would have fallen even further in 2018 had Apple not made incremental purchases that year. Now, the Cupertino company is registering low single-digit revenue growth while Nvidia’s is skyrocketing.

The reason for this change is twofold, and very clear: AI is driving huge demand for high-powered chips, while the smartphone boom has stagnated.

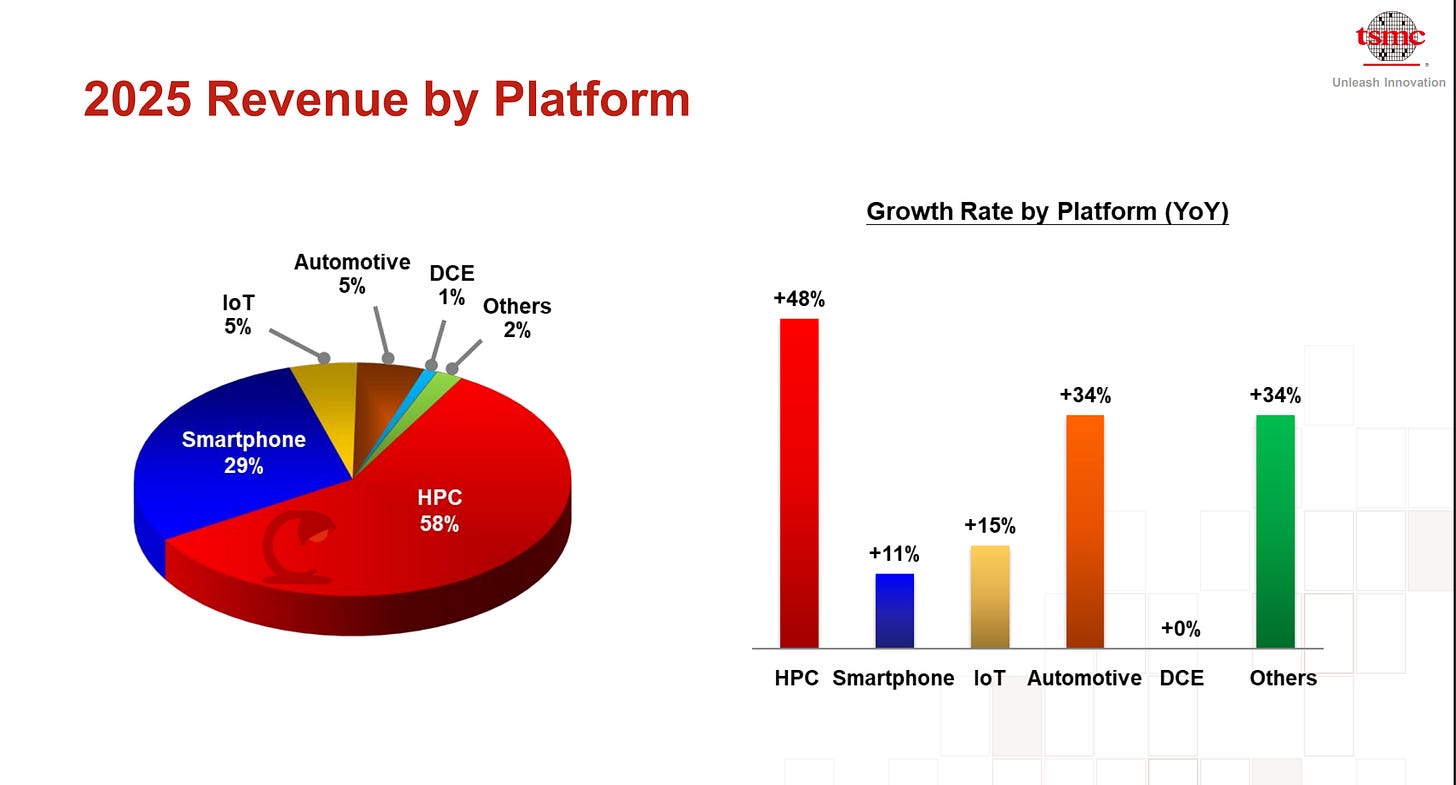

TSMC’s sales from high-performance computing, which include AI chips, climbed 48% last year, on top of a 58% increase the year before. Smartphone revenue grew only 11%, down from 23% last year. This trend will continue this year and in the near future.

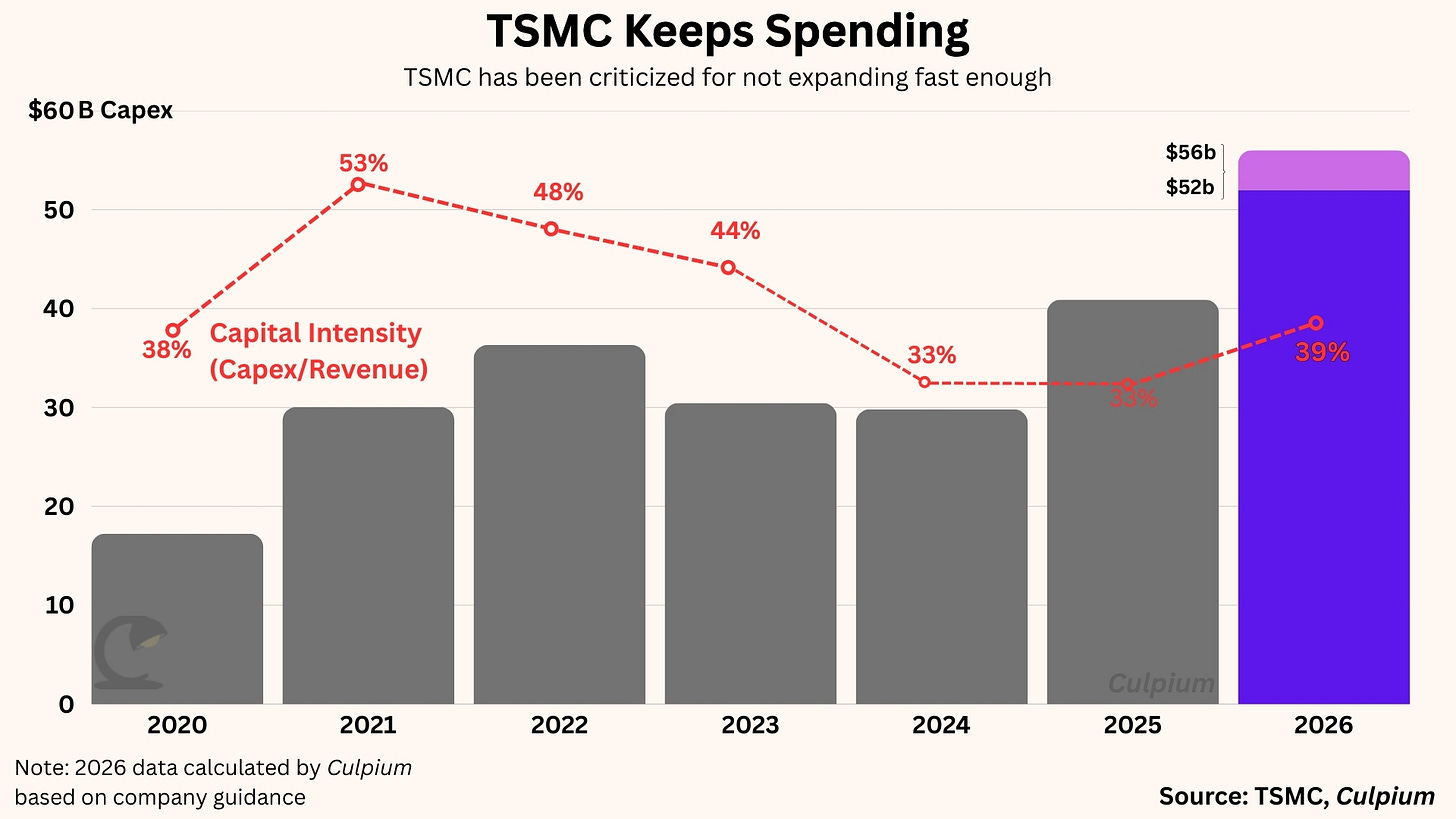

TSMC said Thursday that revenue will rise about 30% in 2026, yet capital spending will rise 32% to a record between $52 billion and $56 billion. The company said that in the long term, growth will average 25% over the five years to 2029, yet the AI segment will climb an average of 55% or more over the same period. This is higher than earlier forecasts of a figure in the mid-40 percent range.

The final blow for TSMC came on Thursday when it showed not only record revenue and net income, but also gross margins on par with software makers and fabless chip designers. In the December quarter, the figure was a surprising 62.3%, 280 basis points higher than the previous period. If it didn’t have overseas fabs (Arizona and Japan) gross margins would be even higher.

Two caveats are important. First, while smartphone processors make up the largest share of chips purchased by Apple, they’re not the only type. Processors for Mac fall under HPC, while it also has a strong lineup of custom chips used in accessories that fall under digital consumer electronics. Second, Nvidia is not the only HPC client. AMD is a major buyer of capacity for its own GPUs while Amazon and Google are among the growing list of customers developing AI chips in-house.

Put another way, Apple’s chip catalog is broader and more diverse, while Nvidia’s lineup is more centered around a large number of wafers at or near the leading-edge. It is for these reasons that Apple will remain important for at least the next decade.

However, in the near term, TSMC’s technology roadmap combined with broader industry trends favoring Nvidia, AMD and their ilk means Apple may need to continue to struggle for capacity over the next year or two.

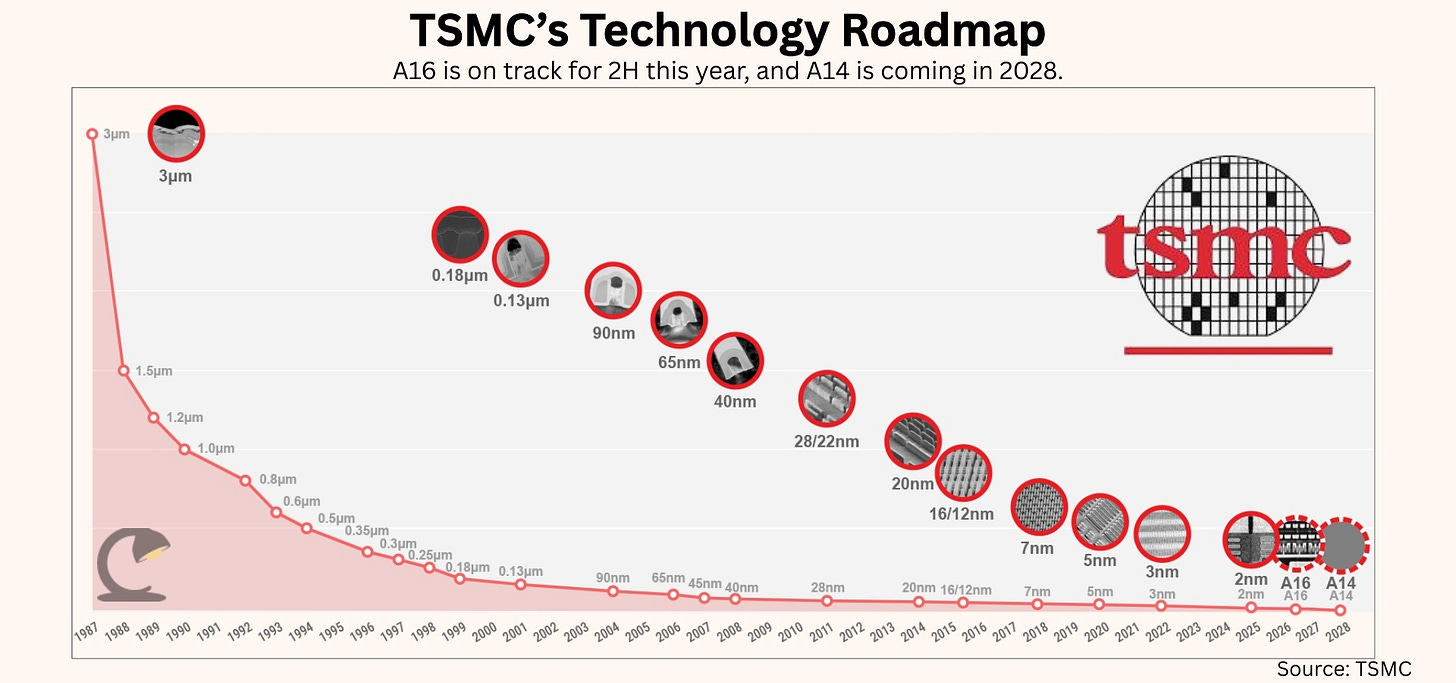

TSMC is already producing chips in quantities up to 2 nanometers (called N2), currently its most advanced node, with Apple a major buyer. But in the second half of this year it is set to roll out a new version called N2P as well as a new node called A16.

The company’s business model is a bit strange. Instead of repurposing an existing factory for new technology, TSMC simply builds a new one. This ensures no interruption in output and allows it to get the most out of old equipment and processes. In general, this means that any new capacity built by TSMC is for a new node. As a result, many of its fabs are still producing chips on technology a decade or more old.

In the words of TSMC CEO CC Wei, the A16 with Super Power Rail is “best for HPCs with complex signal pathways.” SPR is TSMC’s version of backside power, a new approach designed to isolate a chip’s signal from its power supply. Intel is also developing this technology, and many believe it will be key to the US company’s chances of stealing foundry share from its Taiwanese rival.

After that, TSMC has the A14 which it hopes to bring into mass production around 2028. Some people call it the next full node after N2, not A16 as a “full node”. The truth is that all these names are as much marketing terms as they are technology designers. Yet, as Semianalysis recently wrote A great report on the TSMC-Apple relationship, The balance will shift back to Apple as the A14 is designed “from the ground up for both mobile and HPC.”

More importantly, what Apple offers is stability. Nvidia has been a customer for a much longer time than Apple, but by and large it is a bit niche. At the moment that “niche” is the most popular product on the planet, but it is niche. Apple’s products, on the other hand, are being made in at least a dozen TSMC fabs. Even though Nvidia has overtaken Apple in terms of purchases, the breadth of its manufacturing footprint at TSMC is nowhere near as large.

This difference may not matter now, but it probably will at some point. The AI boom won’t last forever. The bubble may burst, or it may gradually subside, but the growth path will definitely become flat and that means the demand for leading AI chips will fall.

Wei knows this, which is why he is expanding rapidly and carefully. “I’m also very nervous,” he said at the company’s investor conference in Taipei on Thursday. “If we don’t do it carefully, it will definitely be a big disaster for TSMC.”

The chip giant has recently faced criticism, including from renowned analyst Benedict Evans, for being “unwilling/unable to expand capacity fast enough to meet Nvidia’s book.” I think this is wrong and unfair.

“The risk of under-investing is much greater than the risk of over-investing,” Evans cited Google CEO Sundar Pichai was saying this back in 2Q 2024, as if to make the point clear. Google’s parent company TSMC and Alphabet have almost identical gross margins. But their business models couldn’t be more different. Nvidia’s financial situation also differs from that of TSMC. Their respective capital expenditure strategies need to reflect this risk.

Alphabet’s capital intensity, calculated by dividing acquisitions of property, plant and equipment by revenue, was just 15% for full-year 2024. TSMC’s capital intensity is more than double that at 33%. More importantly, depreciation – which is the cost of capital expenditures reflected in earnings – was just 10% of Alphabet’s cost of revenue. For TSMC, this figure is four times higher, at 45%.

At Nvidia, which is a tier-one buyer of TSMC’s output, the data is more stark. Capital intensity for 2024 was only 2.5%, while depreciation was only 5.7% of cost of revenues. As a fabless chip maker, it can enjoy gross margins of more than 70%. The only real risk is holding excess inventory. Nevertheless, it could write off its entire inventory at the end of October and still maintain gross margins equal to those of its main supplier. What’s more, none of these customers come close to TSMC’s customer-concentration risk.

The complaint that TSMC could and should build faster ignores the fact that it is the one holding the baby if a recession hits and demand falls. It takes two to three years to build a new fab, Wei explained, so the company needs to think about where the puck is going without thinking too much about where it has been. “Even if we spend $52 to $56 billion this year, the contribution this year will be nothing,” Wei said Thursday. Its major cost, purchasing equipment, remains on the books, no matter how much revenue it generates in the quarter.

For the best part of a decade, Apple was the one requiring TSMC to continue spending on new features. Today it’s Nvidia, and Jensen Huang is starting to harness more power than Tim Cook. But no one really needs to bother with the expensive business of manufacturing semiconductors, let alone the trouble of begging CC Wei for wafers.

For such customers, foundry capacity is a fixed cost they don’t have to worry about. That’s why eight of the ten largest companies in the world turn to TSMC to make their chips, And in return the Taiwanese giant gets rewarded during such bullish times.

Thanks for reading.

Steelmaning Trump’s counterattack on Nvidia’s sale to China

This AI has more memory than bubble dot-com

AI is not the doctor you need in the cancer crisis

<a href