According to Mercury Research, AMD increased its share of all markets driven by x86 processors at Intel’s expense in the third quarter of 2025. Intel is in a strong position, and as its latest offerings for client and server systems have become significantly more competitive than several quarters ago, AMD’s profit pace has slowed significantly. However, during the quarter, AMD achieved two important milestones: it now commands shipments of more than 25% of all x86 CPUs, and it now commands shipments of more than 33% (one third) of desktop x86 CPUs.

Unusual market performance: x86 CPU shipments remained flat quarter-on-quarter

Normally, we start our coverage of the x86 market based on data from Mercury Research with client CPUs, but the third quarter was very unusual as unit shipments of x86 CPUs were flat quarter-over-quarter (QoQ), which is a contrast to the usual seasonal surge when PC makers begin preparations for the back-to-school (BTS) season in June-July as well as the Christmas season in September.

In fact, PC and server makers increased their CPU purchases in the third quarter, but the weakness came almost entirely from Intel, which saw sharp declines in IoT/SoC and entry-level mobile processors as it shifted manufacturing capacity toward server processors, and saw strong shipments of such parts in Q2. In contrast, AMD’s unit shipments ranged from flat to slightly up, so the company gained sequentially and year-over-year (YoY) share, reaching two psychologically important milestones.

For the first time in years, AMD’s unit share of all x86 client and server CPUs shipped exceeded 25% and is now 25.6%, up from 24.2% last quarter and 24% in the same quarter a year ago. Intel still holds 74.4%, but it has lost some share in some segments, allowing AMD to achieve an important milestone amid the market decline.

If we add embedded, IoT, and game console SoCs to the equation, AMD’s share looks even more impressive: 30.9% share of all x86-based chips, up from 25% in Q3 2024. While Intel maintains its dominant position with 69.1%, its 5.9% year-to-date share loss doesn’t look too good. Still, it should be noted that AMD shipped significantly more game console SoCs in the third quarter this year compared to the third quarter of 2024, which slightly inflated its results.

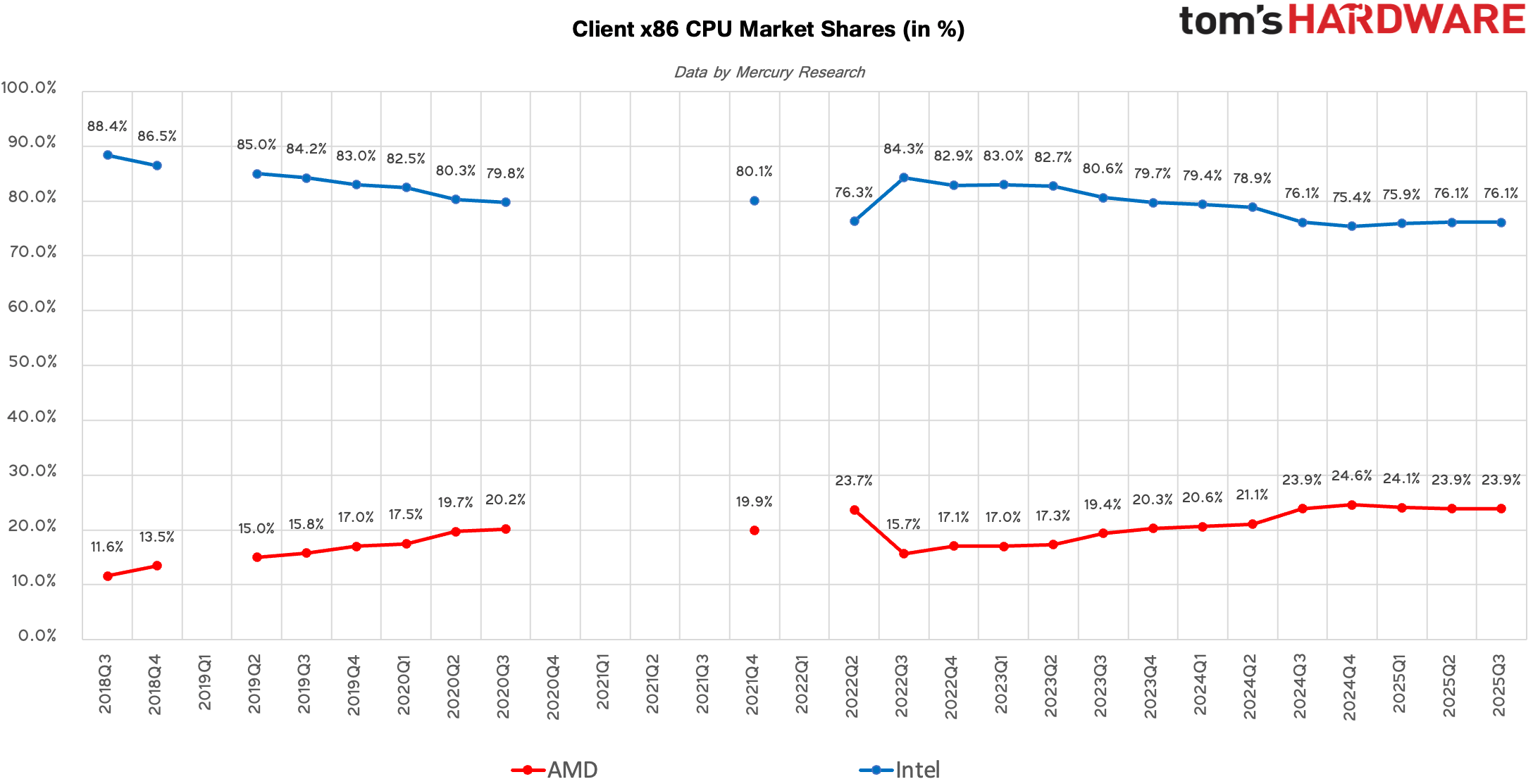

Client CPU: AMD maintains market share

According to Mercury Research data, a strong desktop and mobile CPU lineup as well as Intel struggling with smaller-core mobile CPU supply and prior-generation desktop offerings allowed AMD to slightly edge ahead of Intel in the third quarter both sequentially and year-on-year.

AMD’s customer unit share increased to 25.4%, up 1.5% QoQ and 1.4% YoY, primarily driven by strong desktop momentum. In contrast, Intel’s share declined 1.5% sequentially and 1.4% compared to the same quarter a year ago to 74.6%, as its entry-level mobile shipments were hampered by a shortage in small-core CPU supply. Although Intel still dominates total volume, Q3 numbers reflect ongoing pressure on its mobile PC shipments and AMD’s continued improvement in desktop.

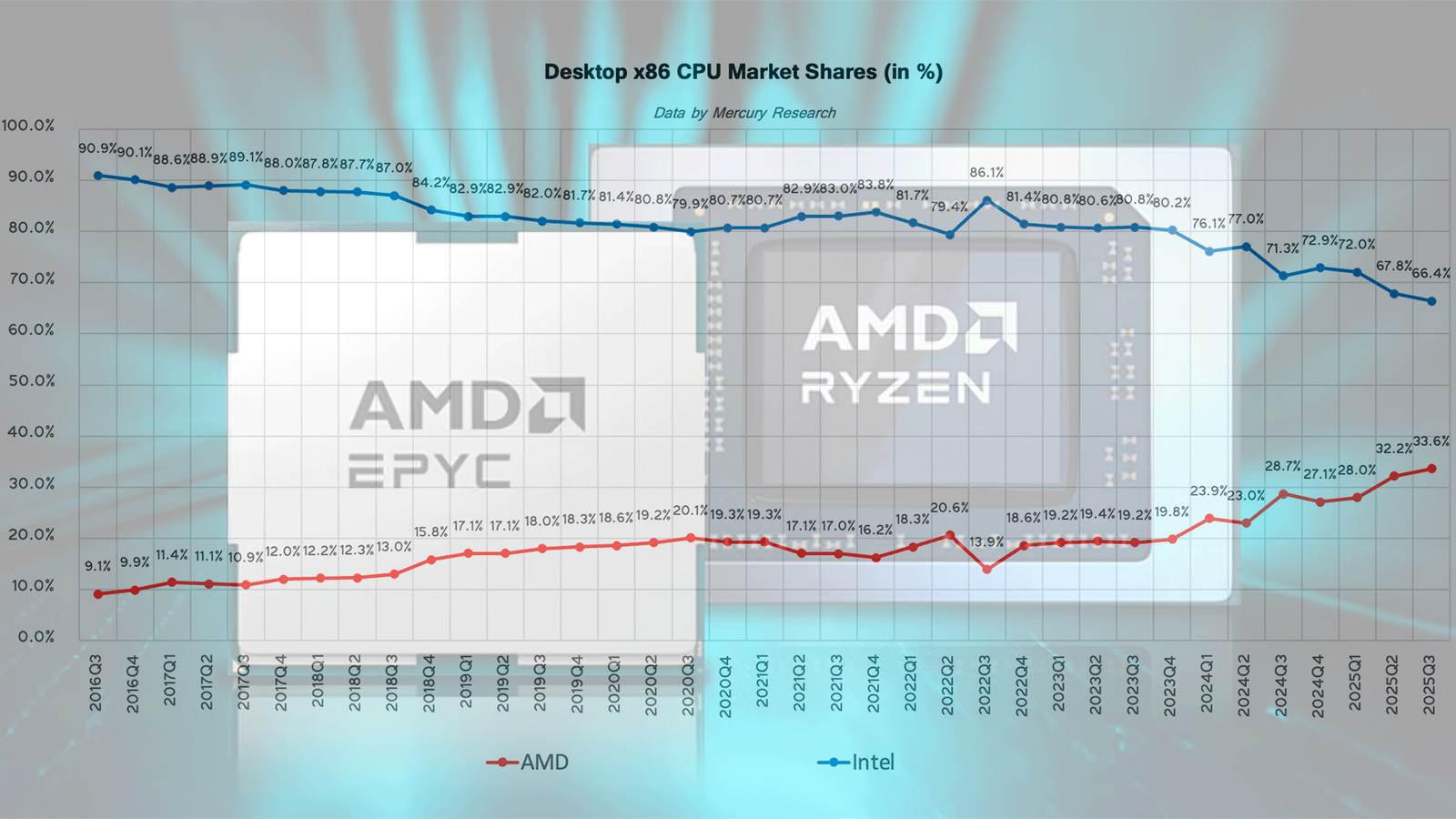

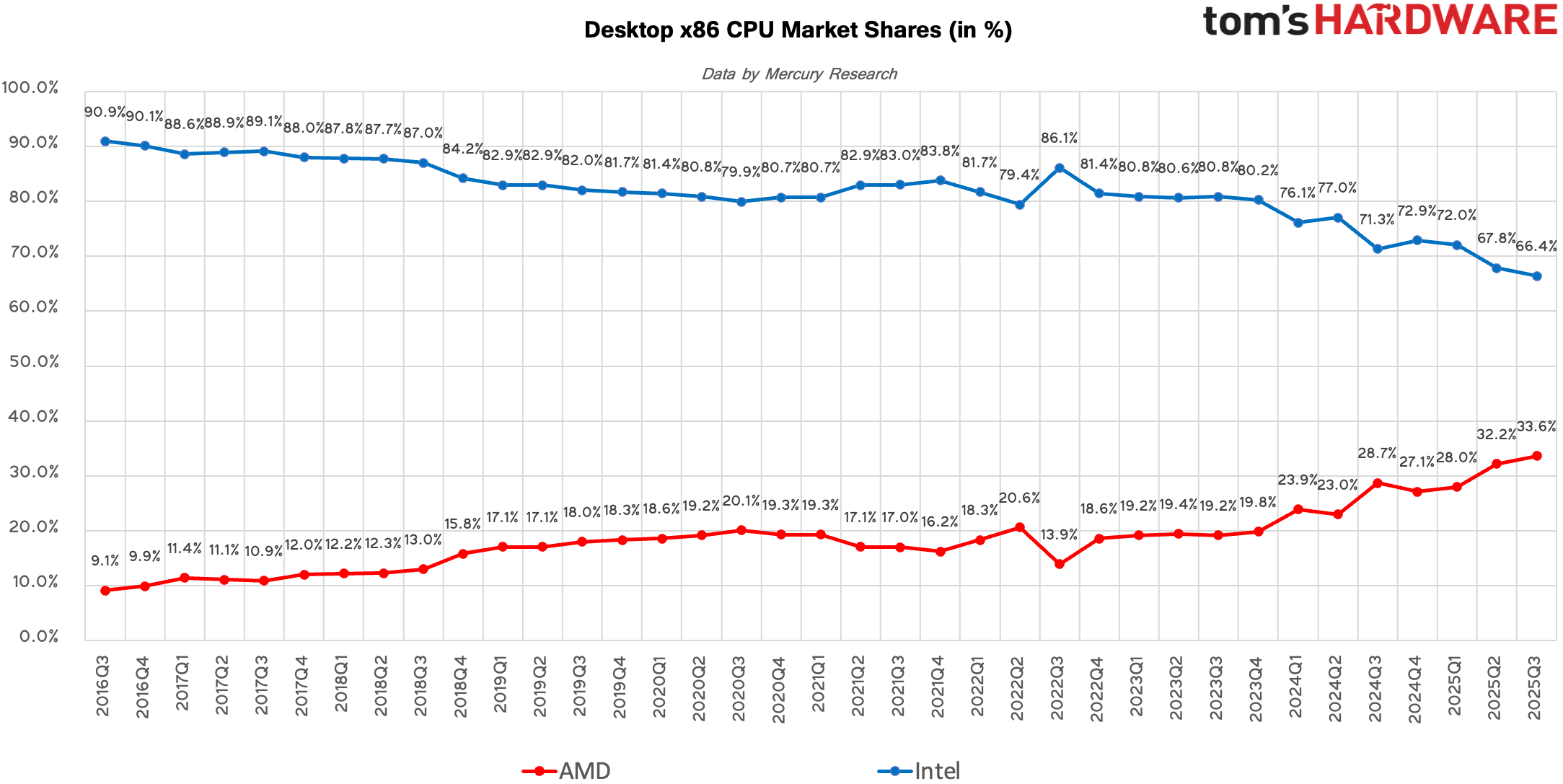

Desktop CPUs: Another great quarter for AMD

According to Mercury Research, both AMD and Intel saw strong sequential unit shipment growth in the desktop CPU market in Q3 2025, although Q2 -> Q3 market growth was generally below normal seasonal rates.

AMD grew very rapidly due to the popularity of its Ryzen 9000-series ‘Granite Ridge’ CPUs in the enthusiast and performance tiers, allowing the company to reach another all-time high: 33.6% share of the desktop PC market, up from 32.2% in the previous quarter and up 5.2% year-over-year. If we compare AMD’s current stake with its stake in Q2 2024, the gain will be 10.6%

Intel still has the majority of desktop shipments, but its share fell from 67.8% to 66.4% QoQ and 71.7% YoY, reflecting AMD’s continued gains in both the mainstream and high-end segments and the lack of Intel’s 13th and 14th core ‘Raptor Lake’ processors, which are still popular in 2022, three years after their original release.

On the revenue front, AMD reached another record quarter for desktop CPU revenue, driven by higher shipments and a strong mix of premium SKUs, the company reported in its conference call a week ago. Intel’s revenue position weakened as its unit share declined and AMD absorbed more of the market’s high-margin demand. Mercury Research says AMD’s revenue growth in desktops has significantly outpaced its unit growth, confirming that the red company continues to strengthen its position in the most profitable parts of the desktop market.

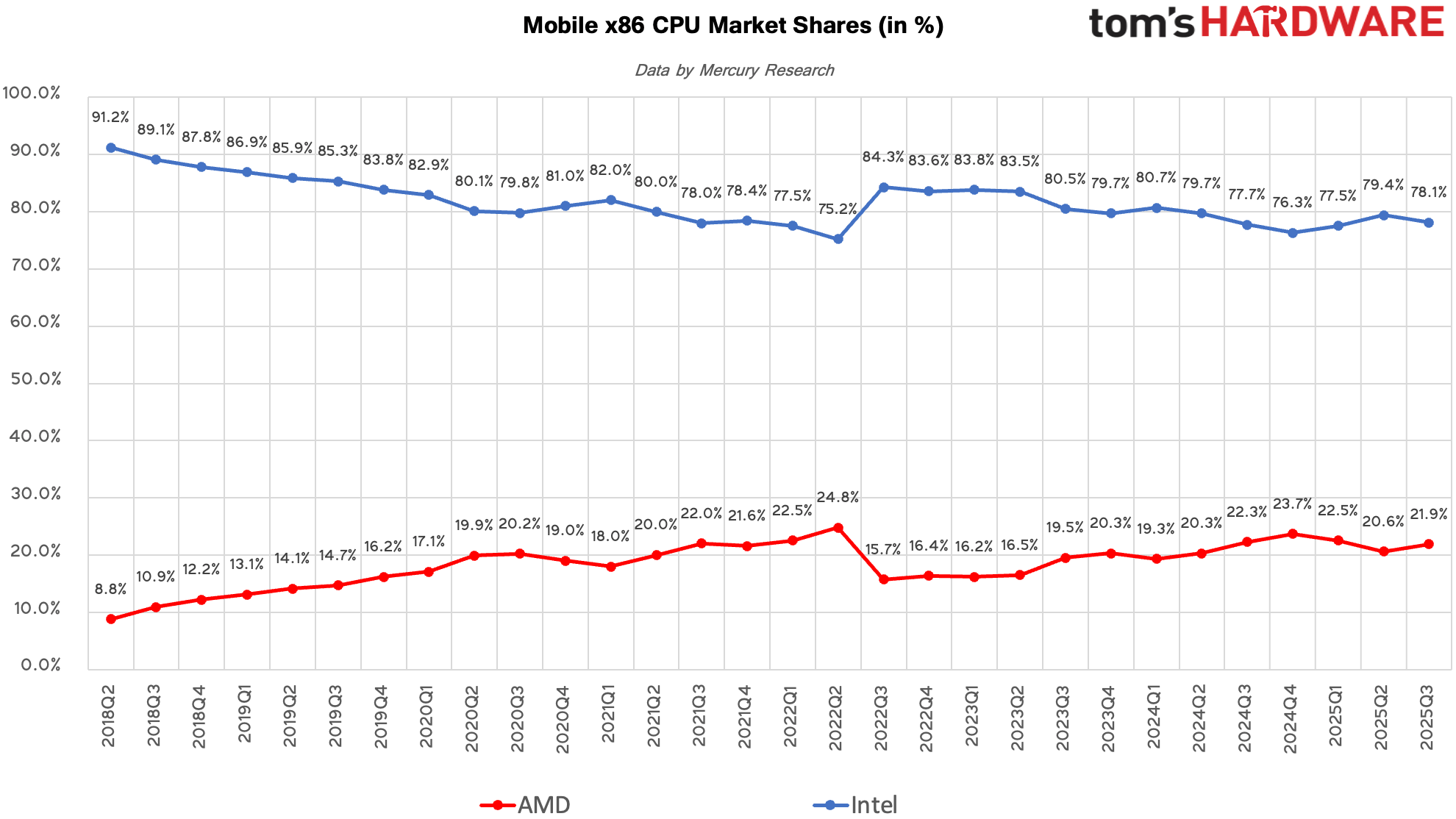

Mobile CPUs: AMD begins to gain share

AMD lost market share to Intel in the mobile CPU space in Q1 and Q2 2025, but the company outperformed Intel in Q3 2025 on a sequential basis, gaining unit share as Intel struggled with lower shipments of its entry-level small-core processors.

AMD’s mobile CPU unit share increased from 20.6% in Q2 to 21.9% in Q3, a sequential gain of 1.4%, while Intel’s share fell from 79.4% to 78.1%, down 1.4% from QoQ. According to Mercury Research, Intel managed to increase shipments slightly, but well below normal seasonal levels, allowing AMD to capture market share during the quarter. Nonetheless, AMD lost 0.4% market share year-over-year, while Intel gained 0.4%.

On the revenue side, the mix probably favored both companies but helped AMD more. Intel’s low-end CPU shortage pushed its average selling prices upward, while AMD – which does not have direct rivals for Intel Atom-like SoCs – benefited from increased shipments of mid-range and premium Ryzen mobile processors as Intel faced some shortages on this side of the spectrum as well.

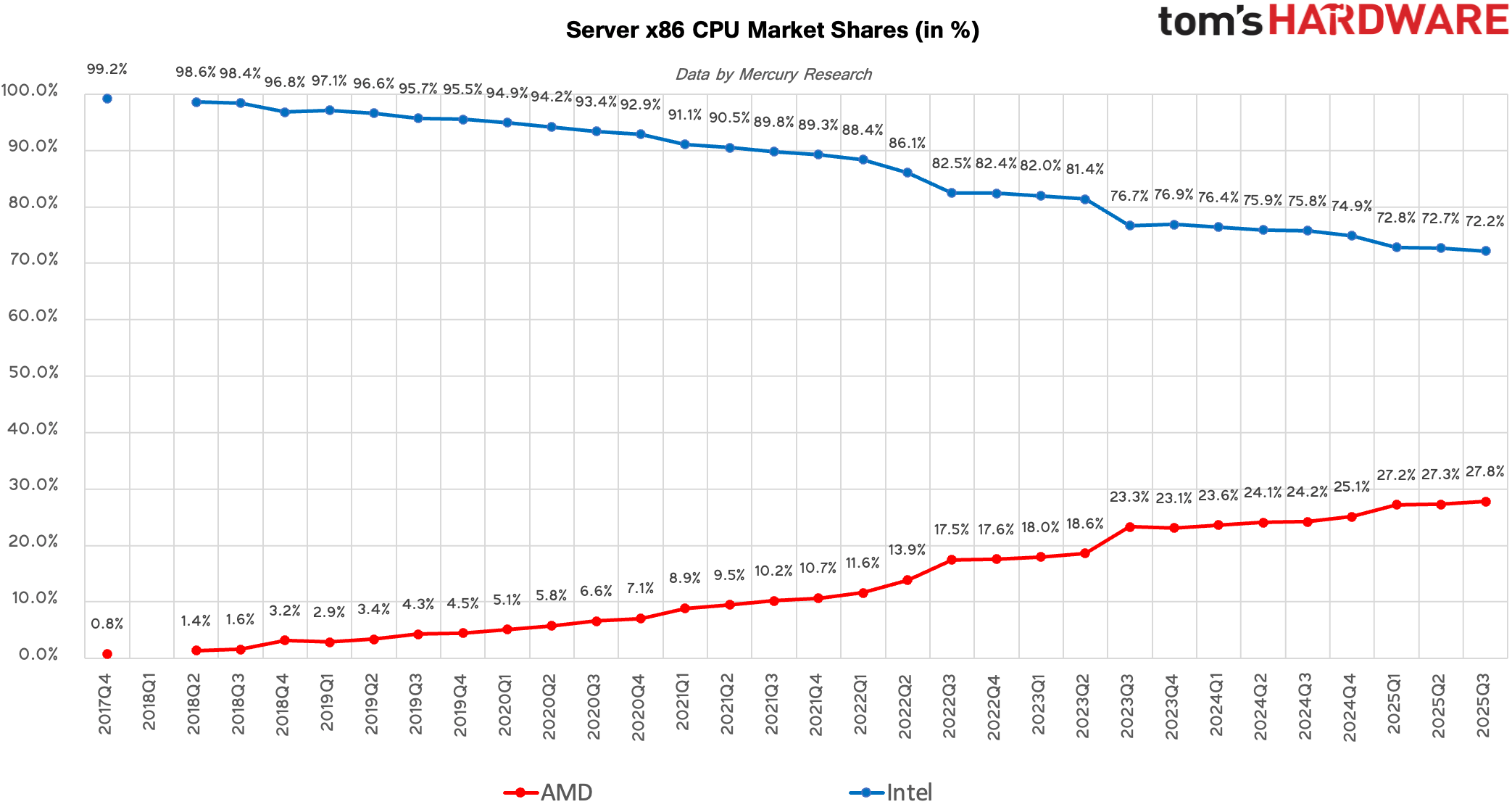

Server CPUs: AMD stagnates amid improving product mix

In the server CPU market, Q3 2025 saw relatively flat unit shipments overall, but while AMD managed to score another small gain, its gains have been negligible this year. Nevertheless, although the sequential movement was modest, it continued AMD’s long-term trend of continuously expanding its presence in x86 servers.

AMD’s server unit share increased from 27.3% in Q2 to 27.8% in Q3, while Intel’s share fell 0.5% to 72.2%. Both companies saw year-over-year shipment growth, but AMD’s growth was stronger, helping it grow unit share higher than the same quarter a year ago, so overall things are looking good for AMD.

According to Mercury, most of the real action in Q3 came from product mix rather than volume. AMD’s EPYC ‘Turin’ ramp accelerated, leading to strong demand for higher-core-count EPYC processors, while Intel saw increased adoption of Xeon 6 ‘Granite Rapids’, which helped boost its average selling prices despite slightly lower unit volumes.

On the revenue side, AMD reached another all-time high, as the mix shifted heavily toward its newest and more expensive EPYC 9005-series platforms. The combination of flat unit shipments and rising prices means AMD’s server revenue is growing significantly faster than its unit share, while Intel’s revenue gains were more limited due to a slight decline in its overall shipment mix.

Summary

In terms of unit share, AMD continued to lead across nearly all major x86 segments in Q3 2025, helped by strong desktop growth driven by the halo effect of range-topping Ryzen 9000-series CPUs and Intel’s struggle to ship enough desktop CPUs of the previous generation, as well as the relatively low popularity of its latest offerings for desktops. As a result, AMD expanded its presence in client CPUs, reached a new high in desktops, and moved upward in servers, while Intel’s share declined modestly as supply constraints and product variations limited its ability to address all orders. Although Intel still leads the market in total shipments, the balance gradually shifted towards AMD.

In terms of revenue, AMD delivered even stronger results, setting new highs in both the desktop and server segments thanks to rising sales of premium processors and the ramp of its latest platforms. Intel’s revenue performance was more mixed: limited low-end supply pushed its average prices higher, but it ceded more share of the higher-margin market to AMD, particularly in desktops and enterprise servers. Then, the company announced a price increase for its popular Raptor Lake processors, which will impact its results in Q4.

to follow Tom’s Hardware on Google NewsOr Add us as a favorite sourceTo get our latest news, analysis and reviews in your feed.